A COLLABORATIVE CLOUD BASED PLATFORM

This is a quick start guide to our accounting platform. Once you become a client you will be contacted for onboarding with more detail. If you are already a client, you can also contact your account manager for additional support.

Anfix is our cloud based, paperless accounting program where you will be able to control your business efficiently from a single platform. With Anfix you will be able to reduce the time you spend on your invoicing as well as having all relevant information within reach for transparent accounting.

Anfix contains CRM functions for you to maintain a register of your providers and clients, an invoicing module that allows you to design, send and follow-up on your sales invoices, as well as a document management function that automatically recognizes your incoming invoices and expenses.

Furthermore, you can connect your bank accounts to the platform to conveniently have all financial information in one place, and there is a corresponding App that allows you to carry your business in your pocket and to upload your documentation by simply taking a picture with your mobile phone.

All these functionalities are provided without additional charge as part of our services, and you will need no further software. Modules for Projects, Stock Management and eCommerce are available, as well as an API for connectivity with other systems.

HOW TO ACCESS ANFIX

In order to register in Anfix, we will send you an email with a link to create your account in the system. Just follow the instructions and create your password to complete the process.

Once your account has been created, you can access the program through the bcnbs.com website, clicking on the LOGIN tab and choosing the ACCOUNTING option. Always use this option in order to make sure the connection is safe, and your personal data are protected.

This is a quick start guide to our accounting platform. Once you become a client you will be contacted for onboarding with more detail. If you are already a client, you can also contact your account manager for additional support.

Anfix is our cloud based, paperless accounting program where you will be able to control your business efficiently from a single platform. With Anfix you will be able to reduce the time you spend on your invoicing as well as having all relevant information within reach for transparent accounting.

Anfix contains CRM functions for you to maintain a register of your providers and clients, an invoicing module that allows you to design, send and follow-up on your sales invoices, as well as a document management function that automatically recognizes your incoming invoices and expenses.

Furthermore, you can connect your bank accounts to the platform to conveniently have all financial information in one place, and there is a corresponding App that allows you to carry your business in your pocket and to upload your documentation by simply taking a picture with your mobile phone.

All these functionalities are provided without additional charge as part of our services, and you will need no further software. Modules for Projects, Stock Management and eCommerce are available, as well as an API for connectivity with other systems.

HOW TO ACCESS ANFIX

In order to register in Anfix, we will send you an email with a link to create your account in the system. Just follow the instructions and create your password to complete the process.

Once your account has been created, you can access the program through the bcnbs.com website, clicking on the LOGIN tab and choosing the ACCOUNTING option. Always use this option in order to make sure the connection is safe, and your personal data are protected.

FIRST STEPS

Once you enter the program there are a few steps you should perform before starting to use the program for your accounting:

Firstly, you should know that even though Anfix is a Spanish program, if you use it through Google Chrome, you will be able to translate the webpage automatically to the language you feel most comfortable with selecting the appropriate option in the browser.

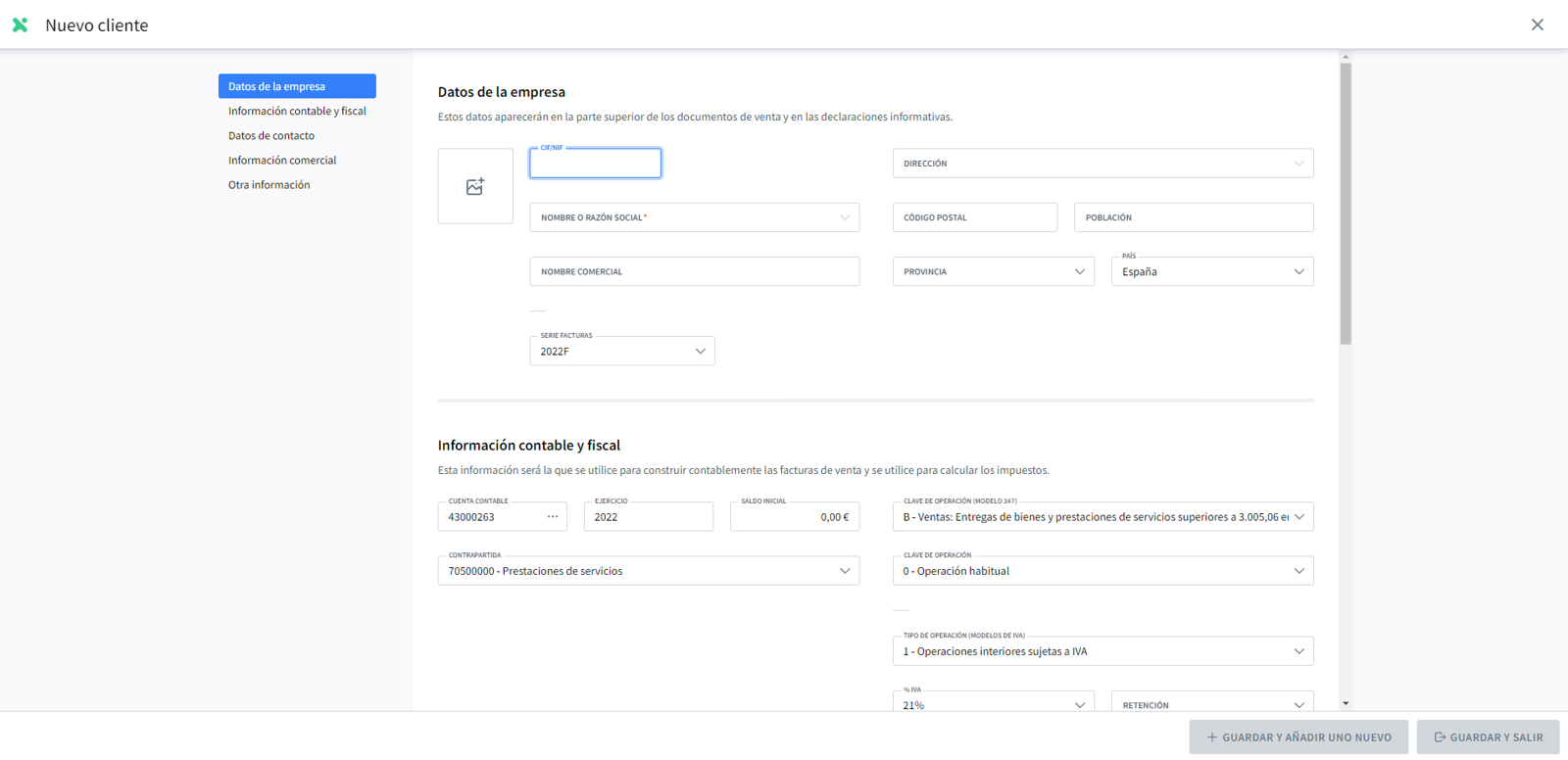

Secondly, you will need to create your customer and suppliers’ database. To do so you should click on VENTAS / CLIENTES / NUEVO. This way you will be able to register them in Anfix with all their tax information and create their own contact form. You will be able to consult the history of each one of them, see at once the value of pending invoices and directly access the related documents (invoices, delivery notes, budgets, etc.).

In order to generate your supplier’s database, you should click on COMPRAS / PROVEEDORES / NUEVO and follow the same steps as when creating your customer database. If your client or supplier is a Spanish company, all information will be automatically completed by just filling in the NIF number based on current trade register information.

HOW TO CREATE OUTGOING INVOICES

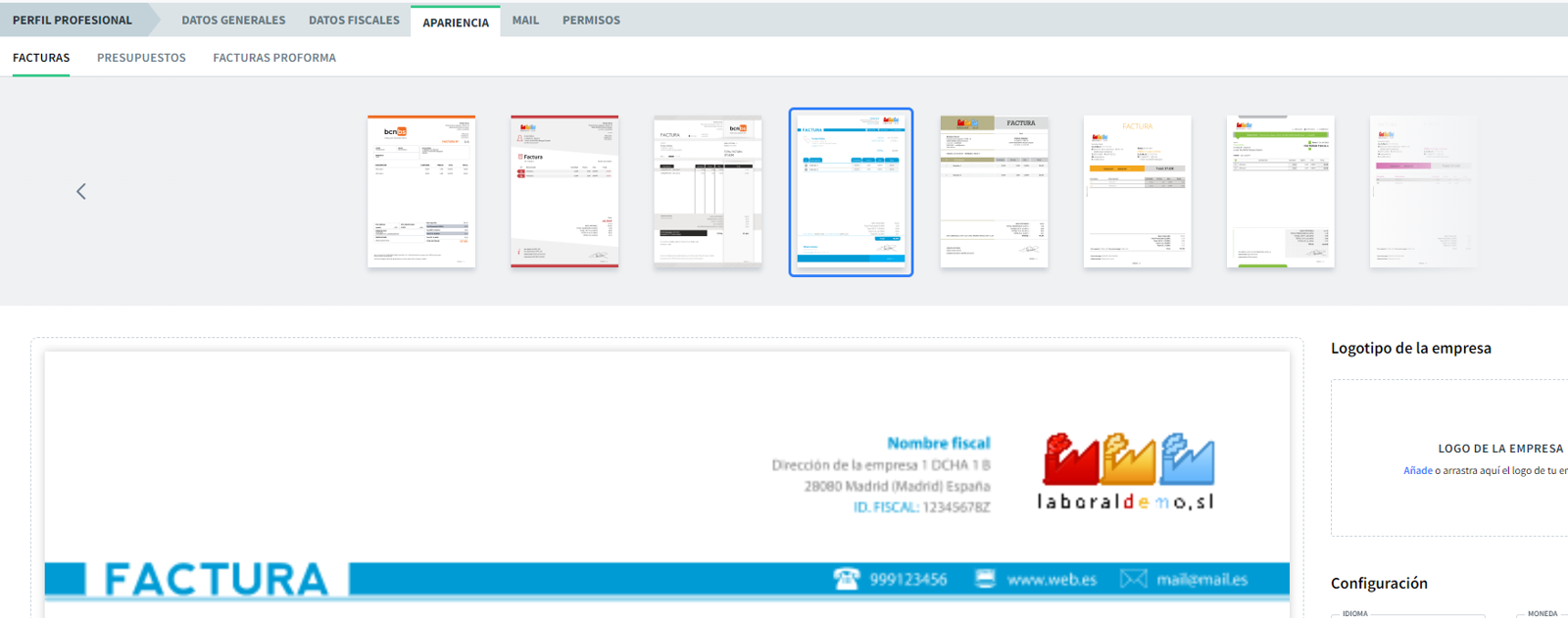

Before creating your first invoice through Anfix you should set up and design your invoice template as you prefer. To do so you should click on CONFIGURACIÓN / APARIENCIA. Anfix offers a large variety of invoice templates, from here you will be able to choose different colors, add your logo, IBAN, and any information you would like to appear always in your invoices.

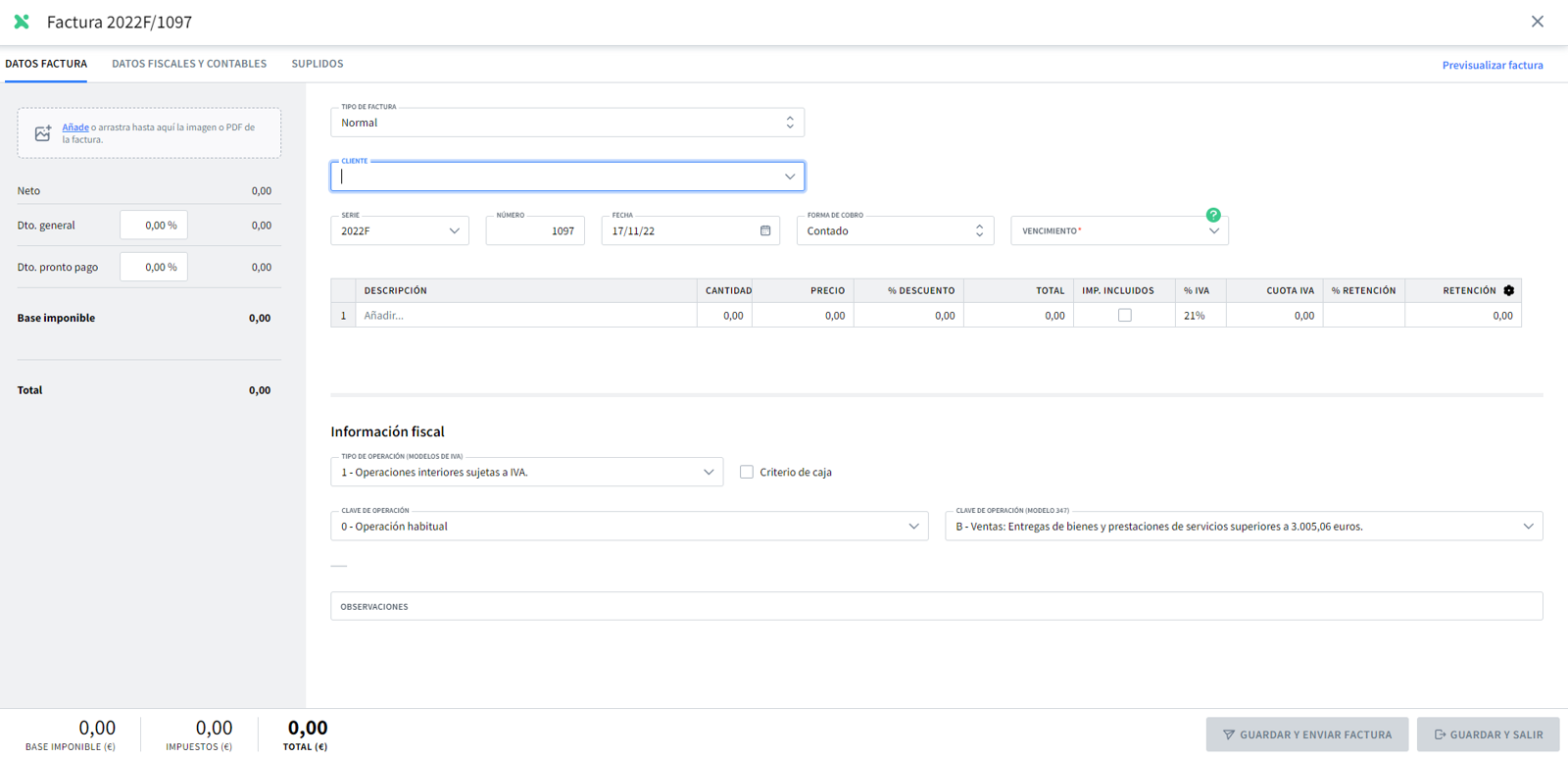

Once you have designed your invoice you can generate your outgoing invoices by navigating to VENTAS / FACTURAS EMITIDAS / NUEVO. From here, you will be able to select the client you have registered before in your database, in this way Anfix enters for you the fiscal details of your clients with 100% reliability. This way you will be able to generate and send your invoices in a fast and reliable way.

In case your services or products are standard, Anfix also offers the possibility to set up those services or products you provide so that you don’t need to fill in all information every time you invoice your clients. To do so, you should click on VENTAS / PRODUCTOS O SERVICIOS / +, in this way when creating the invoice, you can select the product or service that is already set up in the program and it will fill in automatically.

A further option to decrease the time we spend on invoicing is the option Facturas Periódicas,. In case you send the same invoice to your clients each week, monthly, quarterly, etc., you will be able to set up the periodicity of the invoicing and Anfix will make them automatically. To do so you should click on VENTAS / FACTURAS PERIÓDICAS / NUEVO.

Finally, you can also create proforma invoices for your customers - informative invoices that contain all the details of the good or service and the prices offered. In addition, you can send them and transform them into an invoice quickly. You will also be able to add “suplidos” when paying expenses on behalf of your customer.

HOW TO UPLOAD INCOMING INVOICES

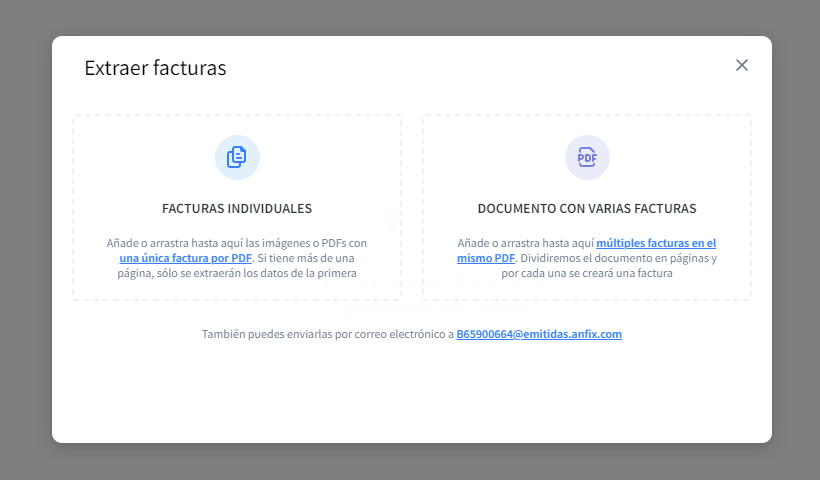

There are three ways to upload received invoices or tickets in Anfix. The first option is to scan your documents and upload them by going to DOCUMENTOS PENDIENTES / + / FACTURA RECIBIDA or TICKET. If you are uploading an invoice, you have to choose between a file containing one invoice (left) or a file containing multiple invoices (right).

Another way to upload the documents is by using Anfix’s application through which you can upload them by taking pictures with your mobile phone. In the following link you will be able to download the App for apple or android. https://www.anfix.com/app-contabilidad-facturacion.

The last option to upload your invoices (not valid for tickets) is to send the documents to (DNI, NIE or NIF number)@recibidas.anfix.com , and they will be uploaded in your account automatically.

BANK CONNECTION

Connecting your bank account to Anfix is necessary to conciliate the bank movements with the documents you upload, as well as to identify any missing documentation. This is done daily so your accounts are always up to date and no deductable expenses are missed. In order to connect your bank account, you should navigate to TESORERIA / MOVIMIENTOS / + BANCO.

You must now choose your bank and introduce your credentials on the following screen as you would normally do when logging in to your account on the internet. By law, this procedure needs to be reconfirmed every 3 months and you will be advised accordingly. Note that this is only a consultative connection, and it is perfectly safe. Nobody will see your passwords at any time and actual bank operations cannot be performed by anyone else but you.

FURTHER SUPPORT

This is a summary of the most important aspects of the application. As mentioned, once you become a client you will be contacted for onboarding with more detail. If you are already a client, you can also contact your account manager for additional support.